As the Fed continues to mull when to begin to cut rates, an important piece of their calculus focuses on wage growth. Rising wages are supportive of consumption growth, but if wages rise too fast, unwanted inflation pressures could emerge. While wage growth has been trending downward over the past few years, it remains elevated. Along with rising shelter costs, the strength of wage growth remains a challenge to a return to the Fed’s 2% inflation goal without a sustained uptick in productivity.

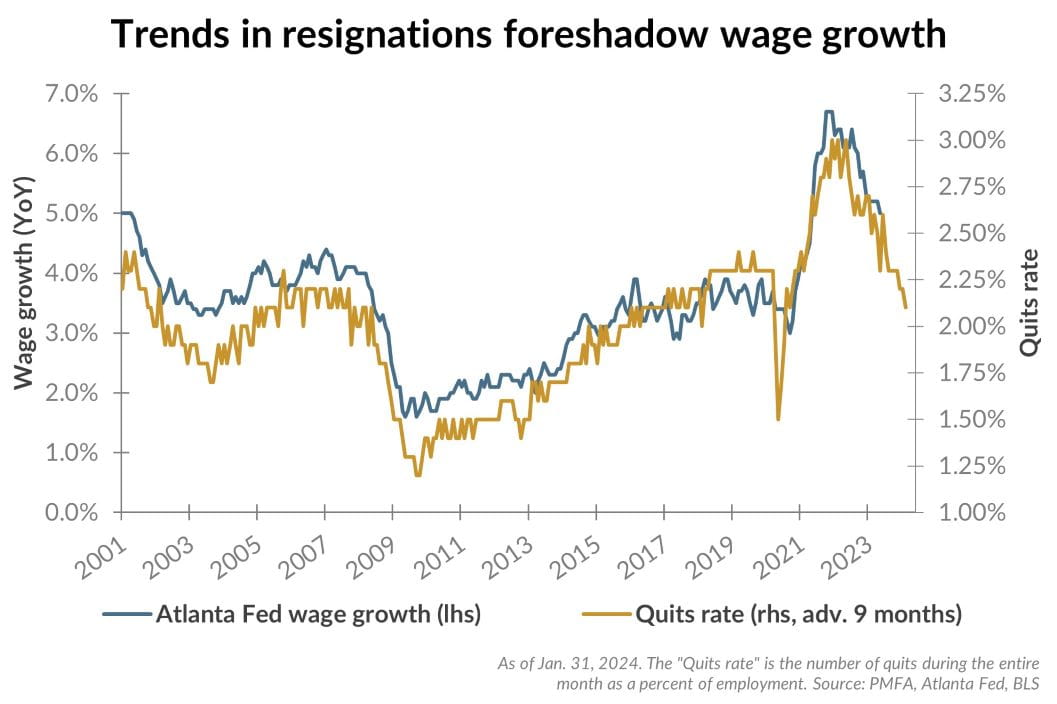

As we discuss in our accompanying piece, the job market remains tight by historical standards, with more jobs than available workers in the United States. However, as the chart above shows, wage growth is projected to continue to fall in the months ahead. The number of people voluntarily quitting their jobs has been a reliable indicator of wage growth, with a lag of about nine months. As indicated in the chart, the quits rate has continued to drop rapidly in recent months. If the historical correlation with wages continues, wage growth should also decline back toward a more sustainable level that would align better with the Fed’s inflation goal.

What’s the bottom line? The Fed continues to monitor data and contemplate when to start easing policy. As yesterday’s FOMC announcement confirmed, the need for a rate cut — and the flexibility for the Fed to deliver one — doesn’t appear imminent. Declining wage growth should help to relieve inflation pressures; whether it’s enough to enable the Fed to move in June (as is currently anticipated) remains to be seen.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.