Elevated interest rates, as a result of the Federal Reserve’s (Fed) monetary tightening program, combined with softening economic conditions may be creating opportunities for credit investors in dislocated or distressed securities. Below are some credit market signals that may indicate a distressed credit cycle ahead, as well as investment strategy considerations should periods of market dislocations and elevated default activity occur. Timing a sustained distressed cycle has always been challenging, especially after the Great Financial Crisis, due to central bank intervention; however, higher interest rates and inflation expectations have meaningfully altered the monetary policy landscape, with a low likelihood of monetary easing in the very near term. Investing in dislocated or distressed credit vehicles now may allow investors to earn an outsized return relative to the past decade.

Credit market backdrop

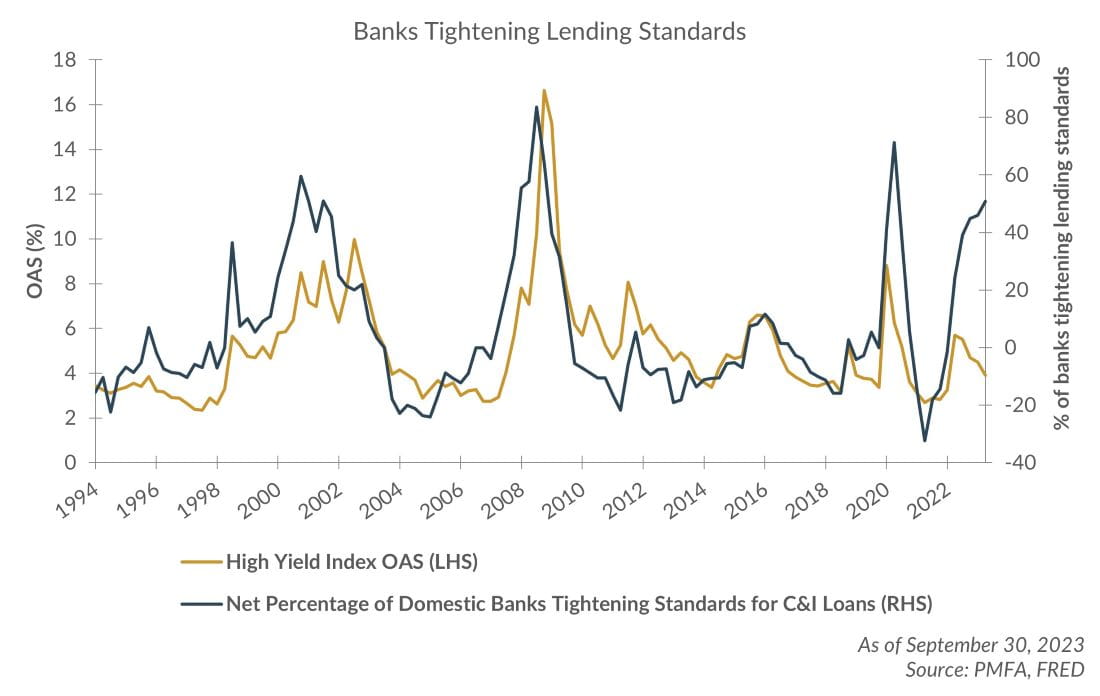

Since the Fed started raising interest rates in 2022, banks and other lenders have been tightening their lending standards in near lockstep. In September, we highlighted how tighter credit conditions have been a frequent precursor to an economic slowdown. Borrowers requiring debt to finance operations are now subject to higher interest rates, shorter duration financing, and stricter financial requirements (also known as covenants) on new debt. Reduced credit availability would put more businesses at risk when obligations are due, and debt needs to be refinanced. Many regional banks are still feeling effects akin to a banking crisis, marked by two of the three largest bank failures in the U.S. history, causing them to sharply reduce available credit.

A sustained period of tighter credit conditions heading into a sizable wall of loans maturing could serve as a catalyst to a period of distress. In the United States, the value of high-yield bonds and leveraged loans set to mature rises from $33 billion in 2023 to $351 billion in 2025 and $806 billion in 20281. Commercial real estate is where much of the opportunity may reside, as there is roughly $2.5 trillion of commercial real estate loans maturing through 2027, $1 trillion of which is coming due at the end of 20242.

Floating rate or variable rate borrowers are already feeling the pinch of higher interest payments. Many investors are pointing to the leveraged loan market as an area to watch for given the large increase in number of loans outstanding and their higher leverage profile. When credit conditions were strong, competition caused crowding in deals, leading to looser covenants in the broadly syndicated loan market. These easier covenants provide less protection for the investors in said loans.

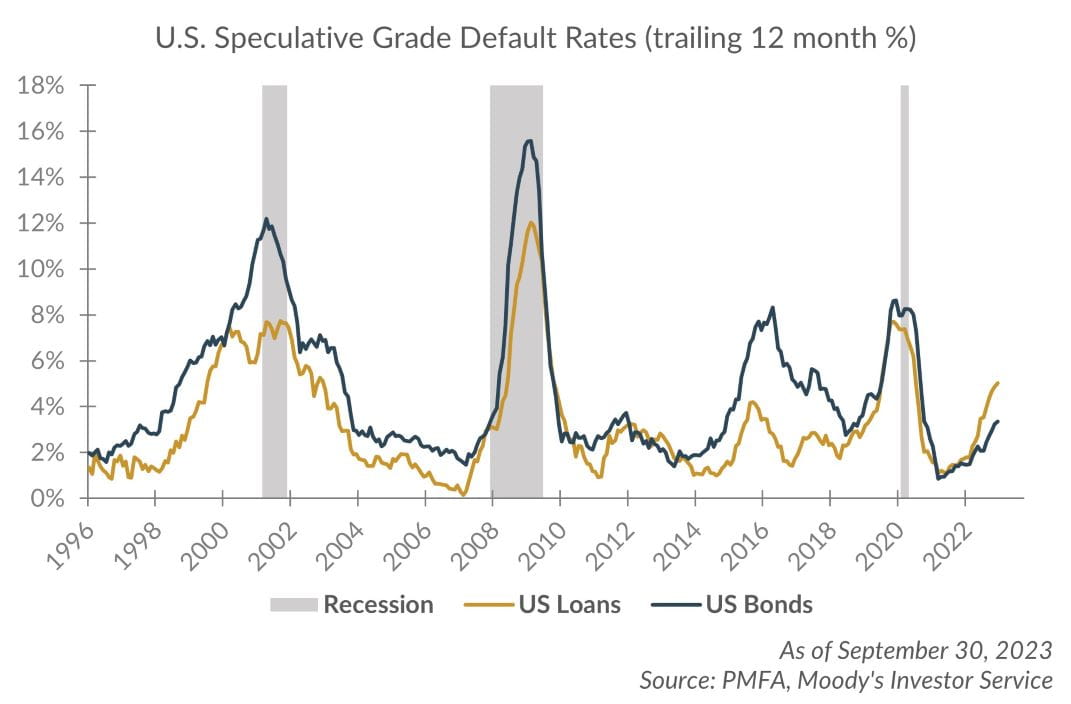

Default rates have been on the rise for the past year. While part of this can be attributed to a normalization to historical averages, it’s also possible that tighter lending conditions and higher interest rates mean many existing capital structures are unsustainable. For debt that may be issued or refinanced today, financing rates are much higher, and borrowers would need to have more cash or cash flow available to comfortably service that debt. In September 2023, the trailing 12-month default rate in the loan market reached 5.0%, up from well below 2% at the end of 2021. Default levels have yet to reach critical levels when compared to past recessionary periods, but the trend is moving in a direction that may create opportunities for distressed credit investors.

Market participants will be watching balance sheet fundamentals closely for signs of distress. One measure of how well a company can pay the interest on its outstanding debt with its earnings is the interest coverage ratio. A lower ratio means that the company has less earnings to cover its interest payments and is more vulnerable to interest rate fluctuations and financial distress. Since the Fed began raising rates, interest coverage ratios have been steadily falling. Both high-yield debt and leveraged loans have seen a drop in interest rate coverage from just over 5x to around 4x3. Again, the levels aren’t inherently reason for alarm, but they’re heading in an unfavorable direction.

Finally, credit spreads are an important measure used to track investors’ changing beliefs about the probability of default, liquidity concerns, or general risk aversion. The spread is calculated by subtracting the risk-free rate (often U.S. Treasuries) from the current market yield of the bond instrument. The difference between these two interest rates is the credit spread. When credit spreads widen (get larger), it indicates investors are more worried about the ability of the borrower to repay the debt. Despite a volatile yield curve, credit spreads have been surprisingly tame throughout the year. If the economy continues to slow and rates remain elevated, we could see a pickup in defaults and wider spreads. Historically, we have seen spreads widen significantly during periods of market stress. This could create attractive opportunities for investors to capitalize on high volatility and poor liquidity conditions, but these opportunities are often short-lived.

Distressed debt investment strategies

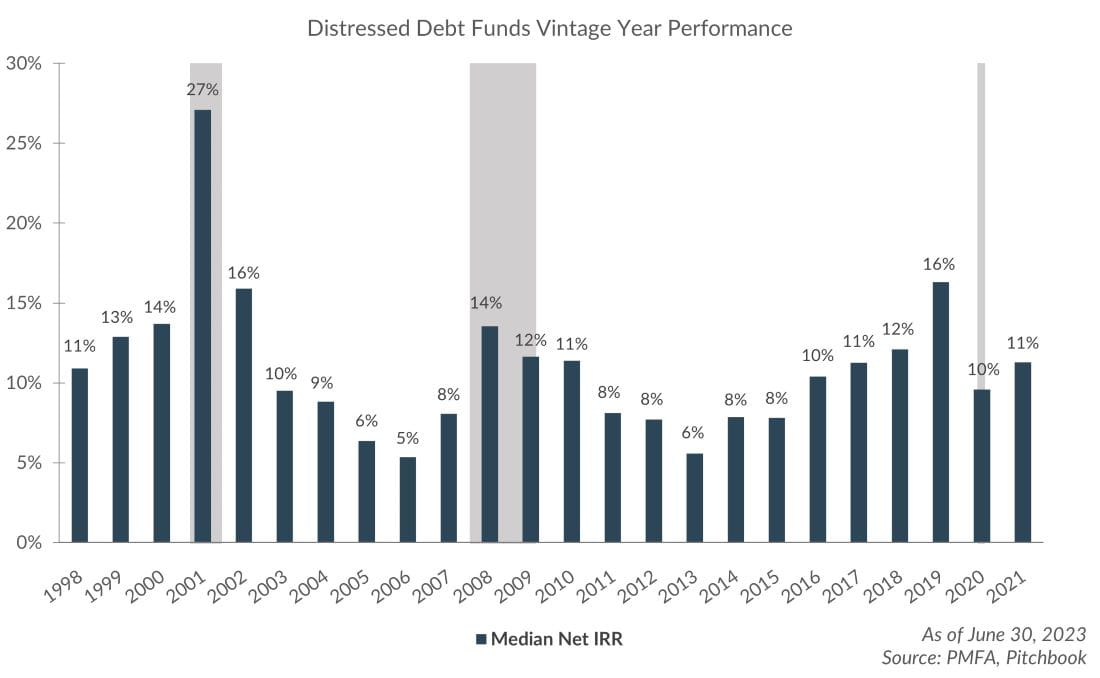

Distressed debt strategies can take advantage of market stress and idiosyncratic opportunities in a variety of ways. As illustrated below, some of the best performing vintages of distressed debt strategies historically, are those that lead into economic slowdowns, including those caused by aggressive Fed tightening. There are two primary strategies, depending on the reason and severity for the stress: trading/hybrid or turnaround.

Dislocated credit (trading or hybrid)

Sometimes a company isn’t fundamentally challenged but is impacted by market technicals such as an indiscriminate sell-off for a particular industry. This debt becomes “dislocated” and is undervalued relative to its true fundamentals. An investor, that can assess the health of the underlying company and understand that the financial struggles of the company or industry may only be temporary, can buy the debt at a discount (reflecting perceived risk) with the expectation that it will eventually correct back closer to its par value.

This type of trading strategy depends on the speed of execution, as once the debt trades down, it’s only a matter of time before other market participants see the opportunity and try to participate in the same trade. As such, these strategies are typically employed by large investment teams who already have in-depth knowledge of the business models and financials of many debtors in the market; they can simply update their pricing models to confirm a thesis before executing the trade.

Distressed-for-control or turnaround

When a company experiences challenges like financial hardships or having too much debt to service, they might benefit from a more holistic turnaround of the business. An investor with the appropriate legal, financial, and operational expertise can come in and facilitate a turnaround of the business and its balance sheet. The company may need to sell noncore assets, for example, a smaller company that wasn’t as accretive or synergistic as expected when acquired, or production equipment that only made sense when demand was higher. The investor will need to properly identify where those inefficiencies lie (and not indiscriminately sell things that are actually important to the business), properly assess those assets to ensure the company is getting a fair price, and bring them out to the appropriate buyer-base.

These strategies will often involve a recapitalization of the company, or simply, an issuance of new debt to pay off old debt. The new debt will be at considerably higher rates, reflecting the additional operational complexity and risk associated with investing in the company, but a portion may also be contractually payable with equity shares in the company instead of cash. These strategies take time to execute and fully play out but could reap an even greater profit in return for their efforts, as the company emerges as a more operationally efficient, higher-valued entity.

Bottom line

Central banks have made it clear that they intend to do whatever it takes to slow down inflation. The policies enacted to tighten credit conditions and reduce the speed of economic growth are starting to take hold, but they tend to act with long and variable lags. The U.S. economy has proven to be resilient, but stress is being seen in certain areas. If this stress continues to grow, there may be attractive investment opportunities ahead. By working with experienced practitioners who are able to navigate these unique opportunities and manage risks appropriately, investors may be provided with outsized returns.

1 Davidson Kempner, J.P. Morgan

https://www.davidsonkempner.com/documents/FG/kempner_full/news/628143_DKCM_White_Paper_-_Back_to_the_Future_-_Are_We_on_the_Verge_of_an_Old-Fashioned_Distressed_Cycle_-_October_2023_FINAL.pdf

2 Market Watch

https://www.marketwatch.com/story/the-1-trillion-wall-of-worry-for-commercial-real-estate-that-spirals-through-2027-81659671

3 Apollo Credit Outlook

https://apolloacademy.com/credit-market-outlook-6/

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.